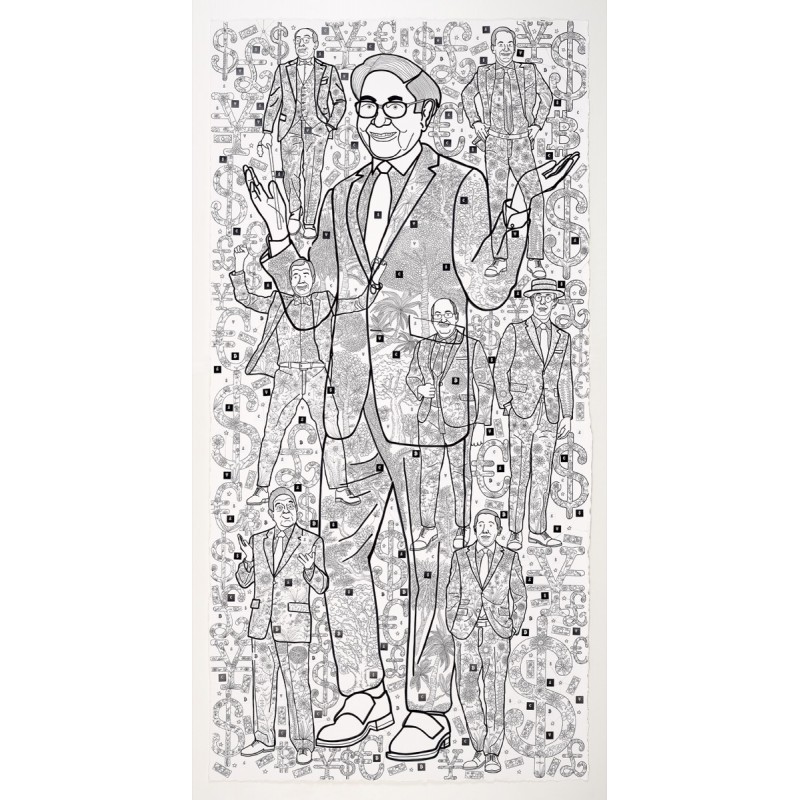

Title: SUPERTRADERS

Format: 150x75 cm

Technique: ink and collage on paper

Warren Buffett (1930, Nebraska, USA)

At 88, he is still the best investor of all time, with an average annual return of more than 20%. He is a regular in the top 10 of the greatest wealths in the world.

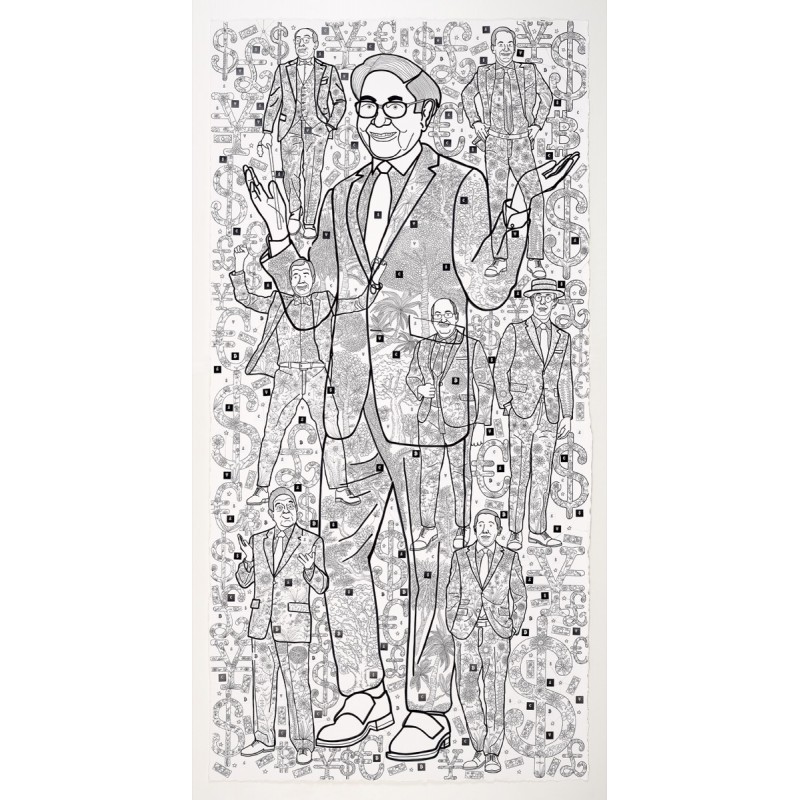

Title: SUPERTRADERS

Format: 150x75 cm

Technique: ink and collage on paper

Warren Buffett (1930, Nebraska, USA)

At 88, he is still the best investor of all time, with an average annual return of more than 20%. He is a regular in the top 10 of the greatest wealths in the world.

His father taught him the world of the Stock Exchange and when he was ten he started to follow the market quotes. At the age of eleven he made his first operations and at 26 he opened his own investment company: Buffett Associates, where he had an initial capital of $ 105,100 from friends and family.

In 1962, Buffett Associates was already managing $ 7.2 million and began investing in Berkshire Hathaway, his current society, today’s largest investment association.

In 2006 Warren announced that he will donate 99% of his fortune to several family foundations and the Bill and Melinda Gates Foundation, the largest charitable event in US history. In 2010, together with Bill Gates, he founded the "The Giving Pledge" company, which aims to recruit more billionaires to donate their fortunes.

André Kostolany (Budapest, 1906- Paris, 1999),

He was a natural-born speculator from his beginnings. He was twice bankrupt but he always managed to overcome the difficult moments and eventually he became a multimillionaire.

His method was to invest counter-cyclically and through independent thinking: buy in times of general panic and sell in full euphoria.

As a good speculator, André Kostolany knew perfectly the short position and used it for his benefit without caring about the moral reasons of his time. He said that the best investment is the long-term investment diversifying in different companies and countries.

Paul Tudor Jones (1954, USA)

The famous "black Monday" of October 19, 1987 when the Dow Jones lost 22.6% and the stock markets around the world collapsed, was for many a disaster, but it meant a fortune for this investor: thanks to his analysis of the S & P500, he was able to predict the big fall and made a strong operation in shorts. It is estimated that on that day he won about 100 million dollars.

Jim Rogers (1942, USA)

He is a singular American investor and a commentator of the financial world.

He is considered "the King of raw materials" and thanks to his accurate estimations in this sector, he made his investment fund, the Quantum Fund (which he founded together with Soros) win the incredible profit of more than 4200% in its first ten years.

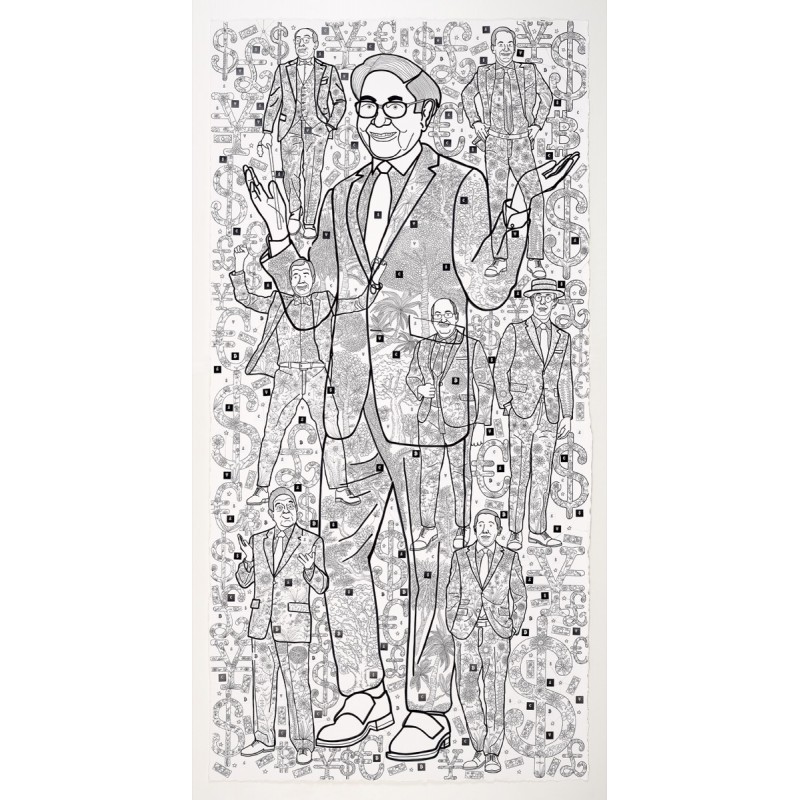

Steve Cohen (June 11, 1956, USA)

Steven Cohen is a fund manager who has won billions by focusing on the stock market.

One of its most well-known funds, Point72 Asset Management, invests mainly in the short and long term and makes significant quantitative and macro-level investments. It has about 1,000 employees, based in Stamford, and maintains affiliated offices in New York, London, Hong Kong, Tokyo and Singapore.

The current estimated net value of Cohen is 13 billion dollars. He is also a great philanthropist and art collector, and is a board member of the Robin Hood Foundation, which focuses on finding out, financing and creating programs to help alleviate poverty in New York.

Jesse Livermore (1877-1940)

One of the most famous traders on Wall Street, "the great bear of Wall Street" and "the boy of bets".When he was a teenager he worked in Boston updating the prices of bonds, stocks and commodities. He soon became familiar with the stock market and developed his own predictive methods.

His first fortune was obtained by gambling in betting houses and he was banned from all the casinos, so he went to the New York Stock Exchange to work as a full-time trader. At the age of 20, he got a great fortune before the San Francisco earthquake in 1906 by falling short with the shares of Union Pacific, as well as with market drops in 1907 and 1929. But after the depression of the 1930s he lost everything. He was a great trader but a bad manager: he learned to generate money, but not to keep it. In 1940 he committed suicide, after writing a letter to his third wife in which he said: "My life has been a failure".

George Soros (1930, Budapest, Hungary)

Soros rose to fame for bankruptcy of the Bank of England on September 16, 1992, known as "black Wednesday", where the pound fell by 15% against the German mark (for which Soros had operated against the pound) and 25% against the dollar. Soros won almost 1,000 million pounds on that day.

In 2015 Forbes estimated his fortune in 24.2 billion dollars, which made him one of the richest people in the world. He is still operating in the market.

Nicolas Darvas (Hungary 1920-1977)

This dancer, self-taught, investor and author, was known thanks to his book "How I won $ 2,000,000 in the stock market." Thanks to his theory called "Darvas BOX theory", which consists of choosing investments according to a combination of technical and fundamental analysis, Darvas converted 10,000 dollars of the 1950s into more than 2,000,000 million dollars. in less than 18 months, becoming one of the richest billionaires of the time.